Looking for Expert-Level VA Claim Answers?📱Call Us Now! 737-295-2226

P&T Disability Benefits

Permanent and total disability, or P&T for short, is a rating classification for veterans who have disabilities that are both total and permanent. Although “Permanent and Total” is a term you’ll often hear in reference to disability ratings—since they do go together for many veterans— you can also have either a permanent or a total rating.

Total refers to disabilities rated at 100%, usually impacting a veteran’s ability to work and maintain a normal life. Permanent means there is little chance of the veteran’s condition improving during their life.

“100% P&T” is often considered the “holy grail” of ratings from the VA because the compensation is substantial, it can’t be revoked, and it comes with a host of other benefits.

In this article, we’ll help you learn about all the benefits of a permanent and total (P&T) VA disability rating . We’ve broken down P&T benefits into several categories, including healthcare, education, and housing. While some benefits are federal, many benefits are also available at the state level.

Veterans with a permanent and total (P&T) VA disability rating may be eligible for the following exclusive benefits:

- CHAMPVA medical insurance

- Chapter 35 Dependents Educational Assistance (DEA) Program

- Death benefits – Dependency and Indemnity Compensation (DIC)

- State-level benefits – including property tax exemptions, recreational benefits, and more; I would also add something along the lines.

Many of the top benefits that come with a 100% rating carry over for a P&T VA disability rating as well, including:

- Monthly VA disability compensation pay

- No-cost health care and prescription medications

- Dental care

- Combat-Related Special Compensation and Concurrent Retirement Disability Compensation

Perhaps the biggest benefit of a P&T rating is peace of mind, because you’re not subject to any future routine examinations unless you file for another claim!

Read on to learn more about the P&T rating, and the many benefits afforded by a total and permanent disability.

- P&T Disability Benefits

- What is a Permanent and Total (P&T) disability rating?

- How do I know if my VA rating is considered permanent and total?

- P&T Disabled Veteran Healthcare Benefits

- Permanent & Total Benefits Video

- P&T Disabled Veteran Education Benefits

- P&T Disabled Veteran Financial Benefits

- P&T disabled veteran housing benefits

- State-level 100% P&T disabled veteran benefits

- Can the VA take away my permanent and total disability rating?

- About the Author

You DESERVE a HIGHER VA rating.

Take advantage of a VA Claim Discovery Call with an experienced Team Member. Learn what you’ve been missing so you can FINALLY get the disability rating and compensation you’ve earned for your service.

What is a Permanent and Total (P&T) disability rating?

A P&T rating is given to veterans whose disabilities are considered both permanent and “total.” The disability generally prevents them from being gainfully employed, and is reasonably certain to continue throughout the veteran’s life.

To be awarded a permanent and total VA disability rating, your VA rating must meet these three requirements:

- You’ve been rated at the 100 percent level, either through your combined disability rating or through Total Disability based on Individual Unemployability (TDIU) (if your TDIU rating is permanent)

- Your disability or disabilities are a result of your military service, or service-connected, and

- There’s medical evidence that your disability will last the remainder of your life

How do I know if my VA rating is considered permanent and total?

VA regional offices have varying methods of letting veterans know they’ve been awarded P&T status.

To determine if you have P&T status, look at the VA decision letter you received from the VA. Some decision letters may display a checkmark for P&T status. Another indication of permanent status is if your letter informs you that no future exams are scheduled. Either of these notations confirm that you have “permanent” status.

The “total” portion of your rating refers to your 100% rating (either 100% schedular or a permanent TDIU rating).

If you have a 100% VA rating, consider whether your condition might improve or not. To learn how to apply for a permanent rating, see our post on writing a VA permanent disability letter.

You might also want to check out our article on how to secure a 100%P&T rating.

Let’s look at the many total and permanent disability VA benefits, starting with healthcare.

P&T Disabled Veteran Healthcare Benefits

The Civilian Health and Medical Program of the Department of Veteran Affairs (CHAMPVA) Insurance

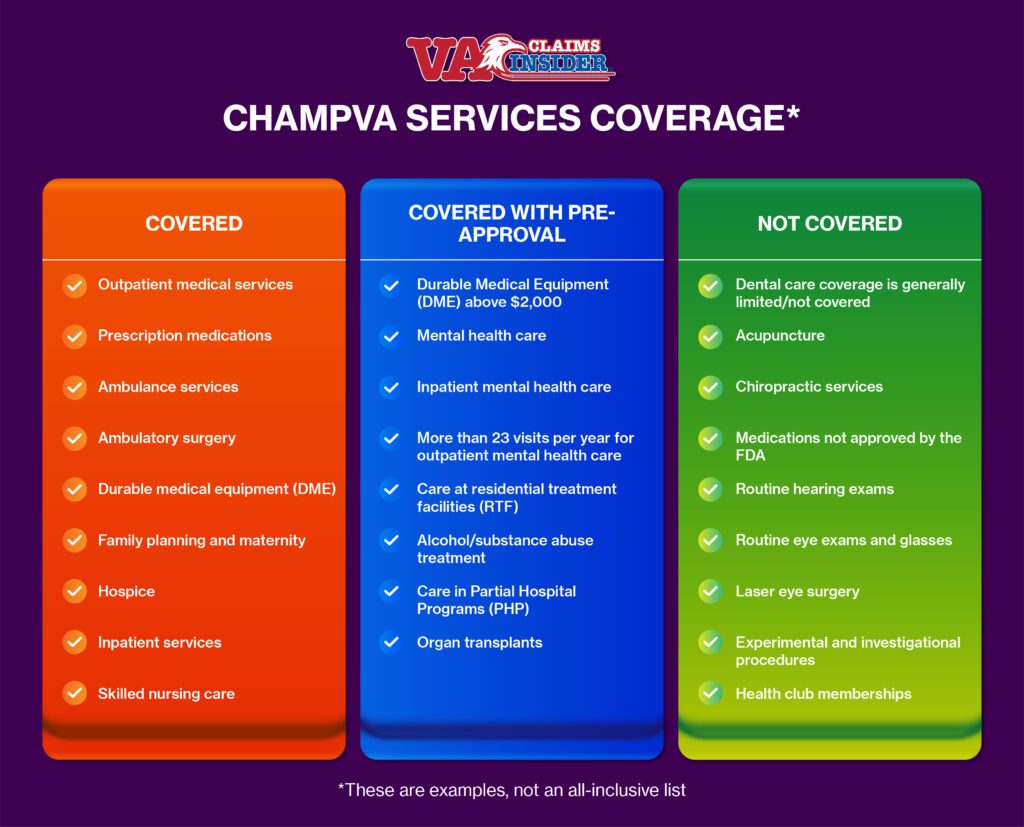

CHAMPVA is an insurance plan covering spouses and veterans’ dependents with a 100% P&T rating. The program covers most medical services.

While most types of medical care don’t require pre-approval, some do under CHAMPVA.

CHAMPVA Cost and Benefit

With CHAMPVA, you and your family will never pay more than $3,000 per year out of pocket for covered services. There may be a 25% cost-share for services depending on Medicare coverage (if you’re eligible for Medicare).

Example: A family member has a $10,000 medical procedure performed. You pay 25%, CHAMPVA pays 75%. This would cost you $2,500. If another procedure costing $10,000 is needed after this, you’ve already hit $2,500 of your $3,000 deductible so you would only pay $500 more. The deductible is $3,000 per year for all dependents.

You can choose from treatment at a VA Medical Center, the CHAMPVA in-house treatment initiative (CITI) program, or treatment from non-VA providers.

Most TRICARE and MEDICARE providers also accept CHAMPVA patients.

To learn more, read our definitive guide to CHAMPVA.

Permanent & Total Benefits Video

P&T Disabled Veteran Education Benefits

Federal and state education benefits are available for P&T disabled veterans and their family members. The VA offers Chapter 35 Dependents Education Assistance Program benefits at the national level. Check with your state’s local Department of Veterans Affairs about state benefits for disabled veterans.

Chapter 35 Dependents Educational Assistance (DEA) Program

The Dependents Educational Assistance Program is a federal program that provides financial assistance to eligible dependents of qualifying veterans who died or are permanently and totally disabled as a result of their service. This program’s benefits are often referred to as “Chapter 35 benefits”.

Who is eligible for Chapter 35 benefits?

If you’re a veteran with a P&T rating, your children and spouse may be eligible for education and training benefits. Children must be between 18 and 26 to use these benefits. Spouses must use benefits within 20 years of the date you’re rated P&T by the VA.

What is covered by Chapter 35 benefits?

Chapter 35 DEA benefits cover college or graduate degree programs, career training courses, career counseling, apprenticeships, and on-the-job training. Your monthly compensation depends on whether you go to school or train full-time or part-time. You can find the current monthly payment rates on the VA’s website.

2018 update: How long you can use Chapter 35 benefits depends on when you start:

- If you begin using them before August 1, 2018: you can use Chapter 35 benefits for up to 45 months

- If you start on or After August 1, 2018: you can use Chapter 35 benefits for up to 36 months

You can learn more about this program and how to apply with our article Chapter 35 Education Benefits for Dependents.

P&T Disabled Veteran Financial Benefits

In addition to the desirable monthly compensation at the 100% level, P&T disabled veterans are also eligible for survivor death benefits. These benefits are known as Dependency and Indemnity Compensation (DIC). DIC is a tax-free benefit for survivors of veterans who died from a service-related injury or illness.

To qualify, P&T veterans must have passed away due to their service-connected condition(s), or meet one of these requirements if their death wasn’t service-connected:

- The veteran had a condition that was totally disabling for at least ten years before death

- The veteran had a condition that was totally disabling since release from active duty plus at least five years before death

- The veteran had a totally disabling condition for at least one year before death and was a prisoner of war who died after September 30, 1999.

DIC benefits for surviving spouses of P&T disabled veterans

The monthly DIC benefit for the surviving spouse of a P&T veteran is $1427.66 (additional amounts may also be added based on various factors). See the 2022 VA DIC rates for spouses and dependents for more information including added amounts and benefit qualifications.

DIC benefits for children of P&T disabled veterans

Here are the monthly DIC benefit rates for children:

- Dependent child or child age 18-23 in a qualified school program (no DIC eligible spouse): $607.02

- Child age 18-23 in a qualified school program (with a DIC-eligible spouse): $301.74

Add $216.54 to the dependent child rate for each additional eligible child.

Children cannot receive both DIC benefits and Chapter 35 DEA benefits simultaneously.

Surviving parents may also be eligible for DIC.

You can learn more about DIC and how to apply by reading our post on VA survivor benefits.

P&T disabled veteran housing benefits

Adapted housing grants

The VA offers grants to qualifying veterans that can help with purchasing or modifying a home to adapt to special needs. For 2022, Specially Adapted Housing grants cap out at $20,387.

You could qualify as a P&T disabled veteran if you meet these requirements: you have the loss (or loss of use of) both hands, severe burns, or specific respiratory injuries. You or a family member must also own your own home.

You can find out more about applying for a housing grant with the VA here.

State-level 100% P&T disabled veteran benefits

State issued ID card for 100% P&T veterans

Receiving the benefits you rightfully earned as a 100% P&T veteran becomes much easier with a disabled veteran state ID card. Apply with your state to easily provide proof of eligibility for many different state benefits.

Hunting and fishing benefits

Many states offer free hunting, fishing licenses, and discounted state park passes for P&T disabled veterans. Check with your state’s department of natural resources, or equivalent, to see what may be available to you.

Property tax exemptions

Many states offer veterans with a P&T rating a complete or partial property tax exemption on their assessed property value. Often this exemption also passes on to a surviving spouse. Check with your local county assessor to see what exemptions may apply to you.

Can the VA take away my permanent and total disability rating?

Many veterans fear that the VA will reduce their VA rating. Over time, most veterans must verify that their disabilities still exist (and are as severe) in order to keep their VA disability ratings as they are.

The great news with a P&T VA disability rating is you no longer need to worry about a rating reduction.

Once you’ve been granted P&T status by the VA, your status will remain with you for life.

In fact, P&T status is one of the seven types of protected VA disability statuses. With P&T status, the VA can’t remove your permanent and total disability rating unless the VA proves you committed fraud in obtaining a VA rating. You’ll also no longer receive compensation and pension (C&P) re-exam requests.

NEED MORE ASSISTANCE?

Most veterans are underrated for their disabilities and therefore not getting the compensation they’re due. At VA Claims Insider, we help you understand and take control of the claims process, so you can get the rating and compensation you’re owed by law.

Our process takes the guesswork out of filing a VA disability claim and supports you every step of the way in building a fully-developed claim (FDC)—so you can increase your rating fast!

If you’ve filed your VA disability claim and have been denied or have received a low rating—or you’re unsure how to get started—reach out to us! Take advantage of a FREE VA Claim Discovery Call. Learn what you’ve been missing—so you can FINALLY get the disability rating and compensation you deserve!

We’ve supported more than 15,000 veterans to win their claims and increase their ratings. NOW IT’S YOUR TURN.

About the Author

Brian Reese

Brian Reese is a world-renowned VA disability benefits expert and the #1 bestselling author of VA Claim Secrets and You Deserve It. Motivated by his own frustration with the VA claim process, Brian founded VA Claims Insider to help disabled veterans secure their VA disability compensation faster, regardless of their past struggles with the VA. Since 2013, he has positively impacted the lives of over 10 million military, veterans, and their families.

A former active-duty Air Force officer, Brian has extensive experience leading diverse teams in challenging international environments, including a combat tour in Afghanistan in 2011 supporting Operation ENDURING FREEDOM.

Brian is a Distinguished Graduate of Management from the United States Air Force Academy and earned his MBA from Oklahoma State University’s Spears School of Business, where he was a National Honor Scholar, ranking in the top 1% of his class.