Looking for Expert-Level VA Claim Answers?📱Call Us Now! 737-295-2226

This guide covers the VA funding fee reduction and a recent change to the VA home loan program.

We’ll look at what funding fees changed and what the new funding fees are. We’ll also examine how much money this VA funding fee reduction can save you.

Let’s get started!

VA Funding Fee Changes 2023

In February of 2023, the VA published a memo announcing a VA funding fee reduction. The funding fee change only affects loans that close on or after April 7th, 2023, and before November 14th, 2031.

Not every funding fee was reduced. Only certain loans now have a reduced funding fee.

VA Funding Fee Rate Charts

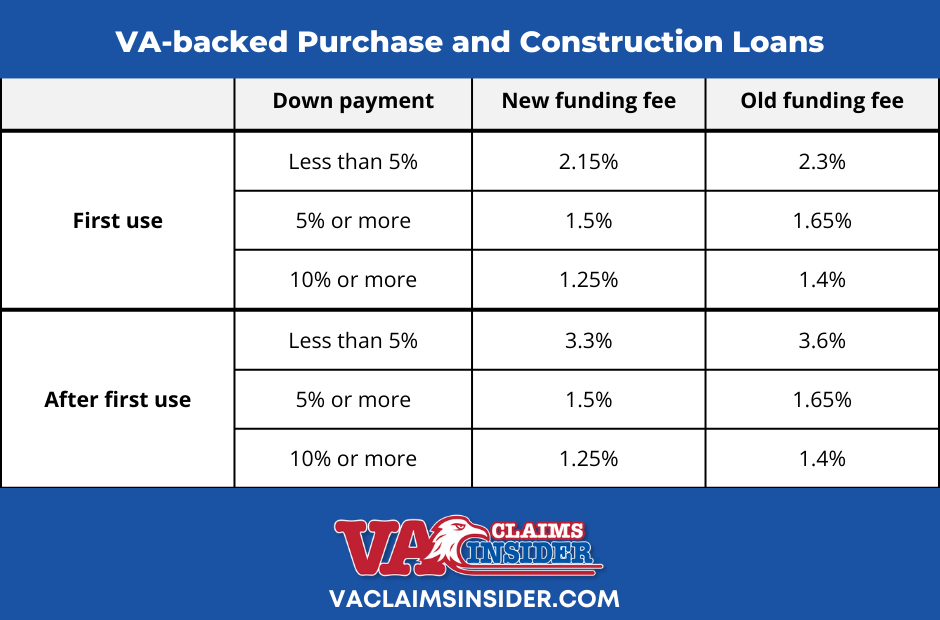

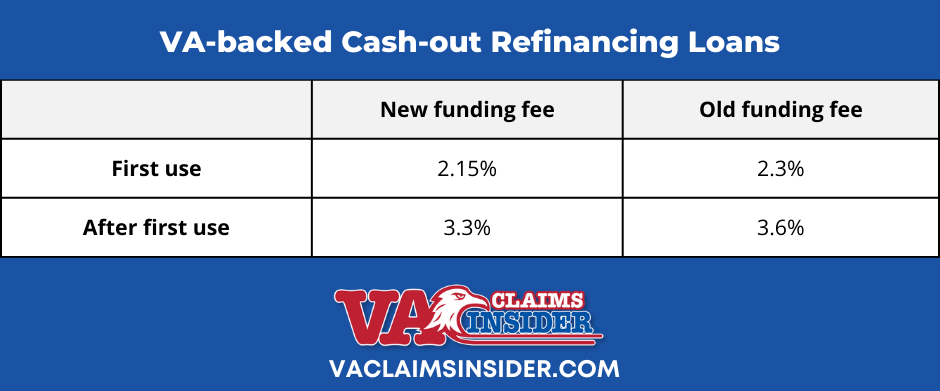

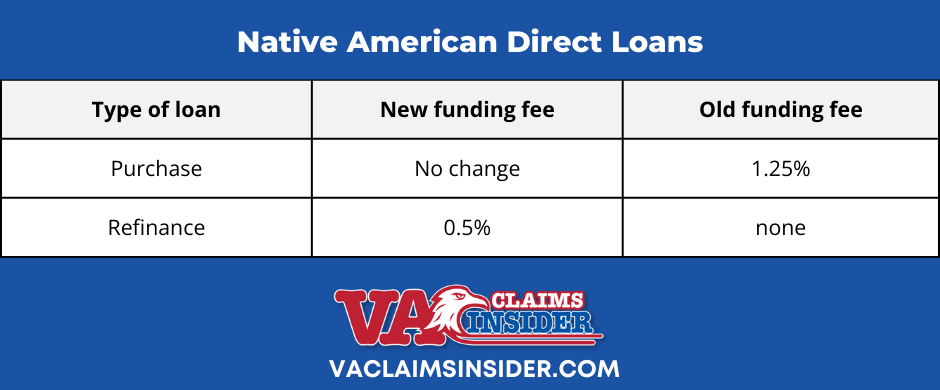

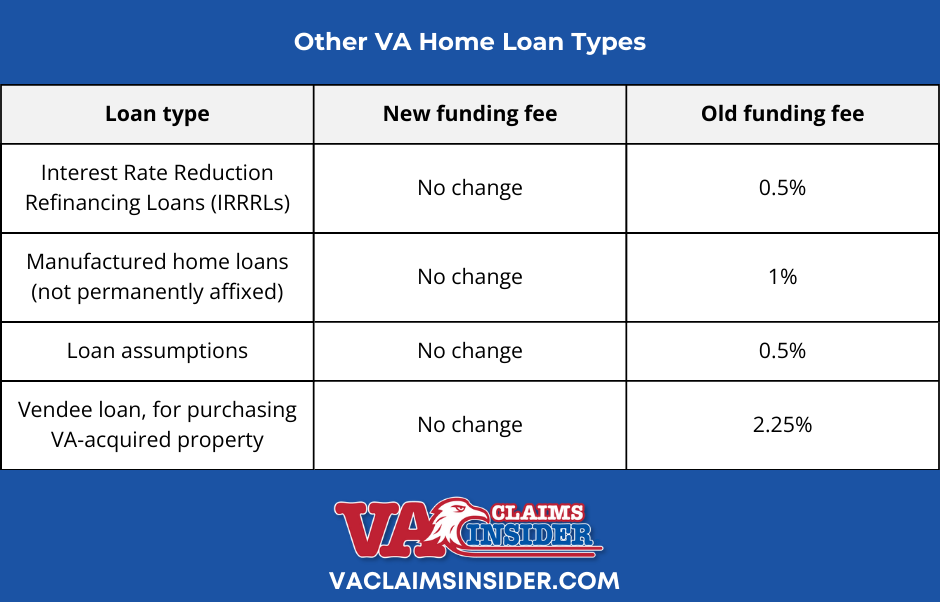

Below, you can find tables of each VA loan type and their associated funding fee. We’ve also included the old funding fee so you can see how much the VA funding fee reduction was.

Keep in mind that VA funding fees can be paid in cash or included in the amount of your loan.

NOTE: The old rates affected loans that closed on or after January 1, 2020, and prior to April 7, 2023.

VA Funding Fee for Purchase and Construction Loans

VA-backed purchase and construction loans saw a significant VA funding fee reduction.

The VA reduced all first-use funding fees by 0.15%. Funding fees for subsequent uses of this loan type are also reduced by 0.15%, except for down payments of less than 5%, which are reduced by 0.30%!

You can use a VA-backed purchase and construction loan to buy, build, or improve property such as:

- A single-family home, up to 4 units

- A condo in a VA-approved project

- A manufactured home or lot

- A new home

You can also use the loan to make changes or add new features to make your home more energy-efficient.

VA-backed purchase and construction loans often offer:

- No down payment is required (unless the sales price is higher than the appraised value)

- Better terms and interest rates than other lenders

- The ability to borrow up to the Fannie Mae/Freddie Mac conforming loan limit on a no-down-payment loan in most areas—and more in some high-cost counties. You can borrow more than this amount if you want to make a down payment.

- No need for private mortgage insurance (PMI) or mortgage insurance premiums (MIP)

- Fewer closing costs, which may be paid by the seller

- No penalty fee if you pay the loan off early

To be eligible for a VA-backed purchase and construction loan, all of the below must be true:

- You qualify for a VA-backed home loan Certificate of Eligibility (COE).

- You meet the VA’s and your lender’s standards for credit, income, and any other requirements.

- You will live in the home you’re buying with the loan.

VA Funding Fee for Cash-Out Refinance Loans

Cash-out refinancing loans saw a VA funding fee reduction as well.

The VA reduced the first-time use funding fee by 0.15% and subsequent use funding fees by 0.30%!

VA-backed cash-out refinance loans can be used to:

- Take cash out of your home equity

- Refinance a non-VA loan into a VA-backed loan.

To be eligible for this VA loan program, all of the following must be true:

- You qualify for a VA-backed home loan Certificate of Eligibility.

- You meet the VA’s and your lender’s standards for credit, income, and any other requirements.

- You’ll live in the home you’re refinancing with the loan.

VA Funding Fee for Native American Direct Loans

There was no VA funding fee reduction for the Native American Direct Loan (NADL). In fact, the VA added a funding fee of 0.5% to the refinance option.

This type of VA loan can be used by Native American veterans or non–Native American veterans married to a Native American to buy, build, or improve a home they plan to live in.

You could qualify for a Native American Direct Loan if all of the following are true:

- Your tribal government has a Memorandum of Understanding (MOU) with the VA detailing how the program will work on its trust lands.

- You have a valid VA home loan Certificate of Eligibility (COE).

- You meet the VA’s credit standards.

- You have proof that you make enough money to cover the mortgage payments and other costs of owning a home.

- You’ll live in the home you’re using the NADL for.

Other VA Home Loan Types

VA loans that fall under the “other” category also did not see a VA funding fee reduction.

This includes Interest Rate Reduction Refinancing Loans (IRRRL), loans for manufactured homes, loan assumptions, and vendee loans.

IRRRLs are the most common loan in this category. They are used to:

- Lower your monthly mortgage payment

- Move your loan from an adjustable or variable interest rate to a fixed interest rate

You could be eligible for an IRRRL if you:

- Are using the IRRRL to refinance your existing VA-backed home loan, and

- Can certify that you currently live in or used to live in the home covered by the loan

How Much Does the VA Funding Fee Reduction Save Me?

How much the VA funding fee reduction can save you depends on four things:

- The type of loan

- The amount of your loan

- How much you put down

- If this is your first or subsequent use

For example, say you want to buy a home that has a market value of $400,000. Because of the closing costs, you want to take out a VA-backed purchase loan of $410,000. It’s a new home and you plan on putting down 4% ($16,400).

This is also not your first time using a VA-backed purchase loan, which means your VA funding fee is 3.3% (granted, you don’t qualify for an exemption).

To find your funding fee, first subtract your down payment from the loan amount (because the VA funding fee is based on the loan amount, not the value of the home). In this example, that equals $393,600.

Next, multiply your applicable funding fee by that amount. In this case, we take $393,600 x .033 to get $12,988.80.

Now, let’s see what you would have paid under the old funding fee: $393,600 x .036 = $14,169.60.

That means the recent VA funding fee reduction would save you $1,180.80 ($14,169.60 – $12,988.80) in this example.

NOTE: For construction loans only, equity in the property can be used as a down payment for calculating the funding fee.

VA Funding Fee Exemptions

There are a few ways to get around the VA funding fee.

If any of these describe you, you could be eligible for a VA loan funding fee exemption:

- You have a VA rating and receive VA disability compensation. OR, you’re eligible for VA disability compensation but are receiving military retirement pay or active duty pay instead.

- You receive Dependency and Indemnity Compensation (DIC) as the surviving spouse of a veteran.

- You’ve received a proposed or memorandum rating before the loan closing date that says you’re eligible to get compensation because of a pre-discharge claim.

- You’ve received a Purple Heart and have provided evidence of it before the closing date of your loan.

VA Funding Fee Waived

Looking to have your VA funding fee waived? A VA rating of even just 10% can make it so you don’t pay a VA funding fee.

If you’re in the market for a VA home loan and want to avoid the pricey VA funding fee, then you should consider pursuing your VA disability.

If you think you’re eligible for a VA rating but don’t know where to start, then you’re in the right place. VA Claims Insider is the #1 most-trusted name in VA disability claims.

All you need to do is reach out and schedule your VA Claims Insider Discovery Call.

This is a short but powerful call that can get you connected with a coach who can support you through the VA claims process.

Have VA Home Loan Questions?

A great way to get answers to your questions about VA home loans is by contacting your VA regional loan center

You can contact a VA home loan representative by calling their toll-free number at 1-877-827-3702, Monday – Friday, 8:00 am – 6:00 pm EST.

Deserve a Higher VA Rating?

Book a no-obligation VA Claim Discovery Call with an experienced team member. We’ll review your situation, spot what the VA may have missed, and help you map out a strategy to unlock the VA disability rating and tax-free compensation you’ve earned for your service. Click the red button below to book your call.

About VA Claims Insider

- VA Claims Insider is the #1 most trusted name in VA disability claims.

- 25,000+ disabled veterans served in our membership programs since 2016.

- Employs 215 teammates; comprised of 74 veterans and 16 military spouses.

- 4.7/5.0 average rating out of 4,500+ total reviews; over 4,000 5-star reviews.