Looking for Expert-Level VA Claim Answers?📱Call Us Now! 737-295-2226

Allen Magtibay, a VA Claims Insider Veterans Claims Expert goes over how Veterans with a 100% Total and Permanent Disability rating can apply to TPD loan discharge program and have student loans through the government forgiven.

One great benefit to obtaining a 100% disability rating is the Total and Permanent Disability (TPD) Discharge Program. This program allows a Veteran to have their federal student loans discharged due to disability. For a Vet who cannot work or struggles to maintain employment, having their student loans written-off can be a lifesaver. I applied for the program and was happy to see that my student loan would no longer be a financial burden for my family and me.

For Vets looking to apply for the TPD loan discharge program, it is relatively simple. All that is needed is for the Vet to visit this website.

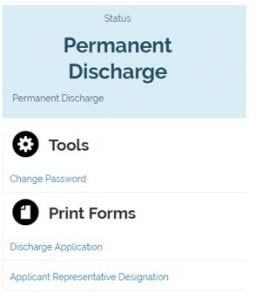

You then need to complete the application and provide the VA Benefits Letter to show proof of the 100% rating. Typically, the approval process takes about 30-60 days from submission date to get the final decision. You can continue to log into the system to check the status. Once approved your status will change to “Permanent Discharge.”

Types of Student Loans that Qualify for Discharge and Effective Date

The type of student loans that qualify for forgiveness under the TPD Discharge Program are federal student loans under the following programs:

- William D. Ford Federal Direct Loan (Direct Loan)

- Federal Family Education Loan (FFEL)

- Federal Perkins Loan (Perkins Loan)

The effective date for discharge for these loans would be the effective date of your 100% rating. The effective date can be huge because if you were making payments after you received your 100% rating, you are entitled to those payments to be refunded back to you. For example, my 100% P&T date was effective September 1, 2017. Because of the delay in my rating, I didn’t apply for the TPD Discharge Program till October 2018 and was not approved till December 2018. Since my effective date for my VA rating was September 2017, my student loan lender refunded me all my payments from that date on.

One misconception out there under the TPD loan discharge Program is that only federal student loan and not a private student can be discharged off. For example, a Vet may have a private student loan out with a lender such as Navient and or Sallie Mae. Because these loans were not part of the federal student loan program the Vet is still on the hook to pay them off and unable to write them off. This is not true. Some lenders may still allow for private student loans to be discharged. A Vet looking to do this should contact their lender. I had a private student loan with Navient that was discharged off. The only difference was the effective date.

Navient, unlike the federal student loan lenders, did not backdate the discharge from my VA rating effective date. They only covered it from my TPD Discharge approval date. What this meant was Navient wrote-off my loan with them not from September 2017 but from only December 2018. I was just happy to see them approve the discharge so did not feel disappointed that I would not be getting a refund for my loan payments.

Tax Ramifications of the TPD Loan Discharge Program

In the past, student loans discharged under the TPD loan discharge program were considered income and the borrower was responsible for the income taxes associated with the discharge. For example, if the borrower had $100,000 worth of student loans discharged that amount would be considered income for the year. This often left the borrower with an enormous debt to the IRS that would create a significant burden on them to pay.

Congress recognized that this was a problem and passed a new law to forgive the tax charge as well. As of January 1, 2018, all student loans discharged under TPD will no longer be considered income. Unfortunately, those that had their discharge application approved before that date are still on the hook for the taxes.

Not Permanent and Total Nor 100% But Can I Still Apply?

Two more misconceptions about TPD is whether or not you have to be permanent and total (P&T) or if even 100% is needed to apply? The answer to both is no. The 100% rating is beneficial because, with this rating, the VA Benefits Letter will be sufficient evidence for the application to get approved. The rating does not need to include P&T it just needs to show that the rating is 100%

Now, for those Vets who are not 100% yet, they feel their condition prevents them from paying back their student loans they can also apply for the program too. They would need to get the application signed off by a medical professional stating that their disabilities prevent them from having the ability to pay the loans back. This option most likely will be scrutinized more by the Department of Education but can be won by the Vet if the medical documentation supports it.

Become an Insider

We’re Veterans helping Veterans Worldwide™, and since 2016 we’ve helped 10,000+ Veterans just like you INCREASE their VA disability rating!

About the Author

About VA Claims Insider

VA Claims Insider is an education-based coaching/consulting company. We’re here for disabled veterans exploring eligibility for increased VA disability benefits and who wish to learn more about that process. We also connect veterans with independent medical professionals in our referral network for medical examinations, disability evaluations, and credible independent medical opinions and nexus statements (medical nexus letters) for a wide range of disability conditions.