Looking for Expert-Level VA Claim Answers?📱Call Us Now! 737-295-2226

If you’re a veteran who receives both retired pay and VA compensation, you may have heard of CRDP and CRSC. But what’s the difference between CRDP vs CRSC? Keep reading to find out.

Table of Contents

Summary of Key Points

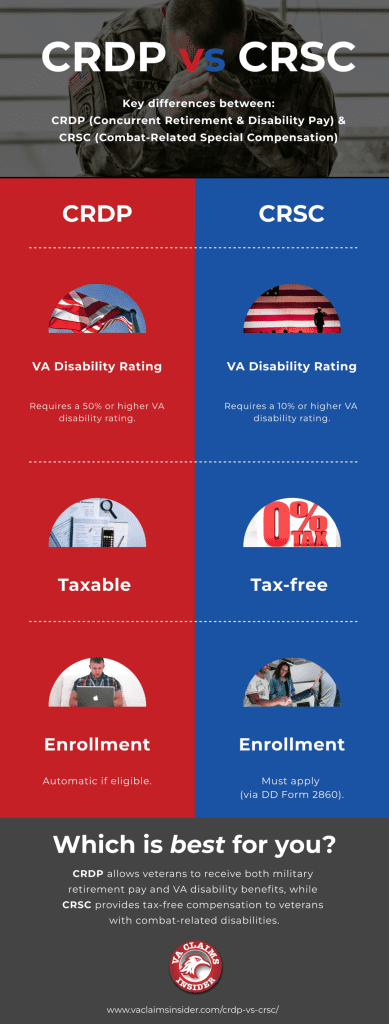

- CRDP allows veterans with a 50% or higher VA disability rating to receive both military retirement pay and VA disability benefits, but the payments are taxable.

- CRSC provides tax-free payments to veterans with combat-related disabilities, regardless of VA disability rating (minimum 10%).

- CRDP enrollment is automatic for eligible veterans, while CRSC requires an application with supporting documentation.

- To qualify for CRSC, your disability must be linked to combat, hazardous duty, or war-related conditions.

Earn VA Disability Pay and Keep Your Retired Pay

If you’re receiving retired pay from DFAS and have a VA disability, you need to know about these two programs (CRDP vs CRSC)! These two programs are designed to help veterans like you get the benefits you deserve without worrying about double dipping.

Traditionally, veterans couldn’t receive more pay than their retired pay. This meant that if you received monthly VA disability in addition to your retired pay, your retired pay would be reduced (by the amount you receive in VA disability benefits). This is also called the VA waiver or VA offset. The good news is that there are now programs that can restore your pay so that you can receive both!

CRDP vs CRSC: Both provide payments to offset the loss of military retired pay. Still, there are several key differences between the two programs.

CRDP, or Concurrent Retirement and Disability Pay, is a program that allows retirees to receive both their military retirement pay and their VA disability benefits.

CRSC, on the other hand, or Combat-Related Special Compensation, is a program signed into law in 2002 that provides tax-free monthly payments to eligible veterans. CRSC provides tax-free payments to retired veterans with combat-related disabilities.

So, which program is right for you? If you’re eligible for both CRDP and CRSC, you must choose one program. Either way, you’ll get the additional monthly compensation you rightfully earned.

How Do You qualify for CRDP vs CRSC?

Although CRDP and CRSC both provide financial assistance to disabled veterans, they are distinct programs with different eligibility requirements.

Time in Service Requirements

You must be retired to be eligible for CRDP or CRSC (served for 20 years or received a medical retirement, including the Temporary Early Retirement Act).

Regular Reserve and Guard retirees usually aren’t eligible for either CRDP or CRSC until they receive retired pay at age 60. However, if you’ve been medically retired, you could be eligible for CRDP before age 60, depending on how many total years of service you have.

VA Disability Rating Requirements (CRDP vs CRSC)

- CRDP – You must have a VA disability rating of 50% or higher

- CRSC – You must have a VA disability rating of 10% or higher

Pay Requirements

- CRDP and CRSC – Your monthly VA disability pay must be causing your DoD retired pay to decrease

Combat Disability Requirement for CRSC

One additional requirement for CRSC that doesn’t exist for CRDP is that your disability must be related to combat. Examples include:

- Armed Conflict (Combat PTSD, gunshot wounds)

- Hazardous Duty (Flight, diving, parachute duty)

- An Instrumentality of War (exposure to Agent Orange, vehicles, or weapons)

- Simulated War (Exercise training)

How to Sign Up

CRDP is an Automatic Enrollment

CRDP is supposed to be automatic if you meet the requirements listed above. Your retired pay will automatically be restored.

You Must Apply for CRSC

To apply for CRSC, you will need to fill out an application with your branch of service and provide documentation of your service-related disability rating.

You’ll fill out DD Form 2860. The form is the same for every branch, but where you send it will differ based on your branch of service.

Include the following in your application for CRSC:

- Medical records related to your combat-related disability

- Purple Heart citations, if relevant

- Other documentation proving your condition is combat-related, official records if possible

- Your DD-214 or retirement orders

Complete instructions are found on the application form, including the correct mailing address for processing.

CRSC Army Mailing Address

Army Human Resources Command

Department of the Army

ATTN: AHRC-PDP-V

1600 Spearhead Division Avenue, Dept. 480

Fort Know, KY 40122

CRSC Air Force Mailing Address

United States Air Force

Disability Division (CRSC)

HQ AFPC/DPPDC

550 C Street West, Suite 6

Randolph AFB, TX 78150-4708

CRSC Navy and Marine Corps Mailing Address

Secretary of the Navy

Council of Review Boards

ATTN: Combat-Related Special Compensation Branch

720 Kennon Street SE, Suite 309

Washington Navy Yard, DC 20374-5023

CRSC Coast Guard Mailing Address

Commander (PSC-PSD-de)

Personnel Service Center

US Coast Guard Stop 7200

4200 Wilson Boulevard, Suite 1100

Arlington, VA 20598-7200

Open Season and CRSC

Traditionally, CRSC Open Season is when DFAS sends you a letter explaining your eligibility for both programs. The letter should explain the differences and amounts you’ll receive with both entitlements. This is your chance to switch your entitlement without filling out Form DD 2860.

Open season is currently January 3-31. Make sure you make the change request by January 31 for your request to be processed.

The Benefits of Each Program: CRDP vs CRSC

The main difference between these programs comes down to taxes. Both programs provide additional income, but CRDP is not a tax-free benefit. CRSC is tax-free, as it’s considered a special compensation disability payment.

How much money will I receive for CRDP?

CRDP recipients will be paid no more than either the total amount of waived retirement compensation or full retired pay—whichever is lower.

Your CRDP may be paid retroactively back to your retirement date or when you were awarded a 50% VA disability rating, all the way back to January 1, 2004.

You’ll receive two checks in the mail each month if you qualify for CRDP:

- From the Defense Finance and Accounting Services (DFAS) – a check for service retired pay restored to the full amount – taxable

- A check for your full VA compensation (from the VA) – non-taxable

How much money will I receive for CRSC?

The amount of CRSC you receive is not fixed and instead fluctuates based on your circumstances. Since the benefit makes up for the retirement pay lost due to your disability pay, the amount you receive from CRSC depends on your rating and waiver. It’s important to remember that you will never get more money back from CRSC than what was initially deducted by the VA.

However, just like for CRDP, you could qualify for CRSC backpay—usually no more than six years of backpay.

You’ll probably receive three checks in the mail each month if you qualify for CRSC:

- From the Defense Finance and Accounting Services (DFAS) – a check for service retired pay with the full VA offset amount subtracted – taxable

- A check for your full VA compensation (from the VA) – non-taxable

- A check for your CRSC reimbursement (from your branch of service) – non-taxable

When You’ll Start Receiving Payments

CRDP Payments

As mentioned above, CRDP is an automatic process that DFAS calculates for you if you qualify. However, mistakes do happen. You should keep an eye on your payments and contact DFAS if you notice any discrepancies.

It can take several months to get your first payment. Be patient, but be on the lookout to ensure you receive back pay if eligible.

CRSC Payments

You will need to apply for CRSC directly, and your payments are not automatic. The application for CRSC can take upwards of six months to process. Expect a decision from your branch of service within six months after you apply.

You’ll usually start receiving CRSC pay within one month of the decision. However, once the application is approved and you receive your first payment, you should continue receiving payments monthly with no further hassle.

Veterans like you have fought hard for our country, and you deserve to receive the benefits you earned. Be sure to research which program is best for you, and take action by applying for the benefits you deserve. Our team at VA Claims Insider is with you every step of the way. Reach out to us today if you need support with your VA claim.

(FAQs) Frequently Asked Questions

What is the difference between CRDP and CRSC?

CRDP (Concurrent Retirement and Disability Pay) allows veterans to receive both military retirement pay and VA disability benefits, but it is taxable. CRSC (Combat-Related Special Compensation) provides tax-free payments to veterans with combat-related disabilities, and it requires an application.

How do I qualify for CRDP?

To qualify for CRDP, you must have a VA disability rating of 50% or higher and be retired or have received a medical retirement.

How do I qualify for CRSC?

To qualify for CRSC, you need a VA disability rating of 10% or higher and must have a combat-related disability (e.g., PTSD from combat, injuries from war, or hazardous duty).

Is CRDP automatically enrolled?

Yes, CRDP is automatically applied if you meet the eligibility requirements, and your retired pay will be restored.

Do I need to apply for CRSC?

Yes, you must apply for CRSC by submitting DD Form 2860 along with documentation of your combat-related disability, including medical records and service-related citations.

Which program should I choose—CRDP or CRSC?

If you qualify for both programs, you must choose one. CRDP is ideal for veterans with a 50% VA disability rating or higher, while CRSC is for veterans with combat-related disabilities, regardless of their VA rating (starting at 10%).

Want Expert-Level Support with Your VA Disability Claim? WE GOT YOUR SIX!

How does VA Claims Insider help veterans?

We make the confusing and frustrating VA claim process EASY through our 8-step proprietary system and one-on-one coaching; we’re the VA Claim EXPERTS you can trust, and YOU are never alone in this fight against the VA!

You’ll also receive VA disability expert Brian Reese’s SEM Method Blueprint—a proven formula that has helped over 25,000 veterans win their VA disability claims faster:

Strategy + Education + Medical Evidence = VA Rating and Compensation You Deserve FASTER!

Start today and unlock an exceptional level of service you deserve for serving our country:

- You’ll hear from a VA Claim Expert over email within 15 minutes of signing up today.

- You’ll hear from your Veteran Coach team within 24 hours of all inquiries during normal business days/hours.

- Our terms are clear and simple: If we don’t win, you don’t pay. You have nothing to lose and everything to gain.

Click the red button below to start the process of winning your VA claim right now!

About VA Claims Insider

- VA Claims Insider is the #1 most trusted name in VA disability claims.

- Work directly with a VA claims coach who can help lead you to VA claim victory.

- 25,000+ disabled veterans served in our membership programs since 2016.

- 30% average rating increase for veterans who complete our #1 rated Elite program.

- 4.7/5.0 average rating out of 5,500+ total reviews; over 4,500 5-star reviews.

About the Author

Trisha Penrod

Trisha Penrod is a former active-duty Air Force officer. As an Intelligence Officer, she led teams of analysts to apply advanced analytic skills to identify, assess, and report potential threats to U.S. forces.

Trisha attended the U.S. Air Force Academy and holds an MBA from Webster University. After receiving an honorable discharge in 2018, Trisha worked as a growth marketer and utilizes her analytic skills to help others accomplish their business goals.