Looking for Expert-Level VA Claim Answers?📱Call Us Now! 737-295-2226

Yes! It’s possible to get a VA loan for a mobile home.

With home prices and interest rates on the rise, many homebuyers are looking for a smaller, more affordable footprint. Nearly 20 million Americans across the US have found it in mobile homes.

If this describes you, and you served our country in the armed forces, then you could be eligible for a VA loan to make your mobile home dreams a reality.

In this post, I simplify the qualification criteria and answer several questions related to getting a VA loan for a mobile home.

Let’s dive in!

Table of Contents

Mobile Home vs. Manufactured Home

The terms “mobile home” and “manufactured home” are often used interchangeably. The two are nearly identical in design and in how they’re manufactured.

The only real difference between a mobile home and a manufactured home is when it was built:

- Built before June 15, 1976 = mobile home

- Built after June 15, 1976 = manufactured home

NOTE: While not technically correct, I say “mobile home” throughout this post because this is the term most people are familiar with. Keep in mind that I’m always referring to homes built after June 15, 1976.

Can You Buy a Mobile Home with a VA Loan?

Yes, you can buy a mobile home with a VA loan as long as the mobile home:

- Was built after June 15, 1976 (the VA doesn’t allow loans for mobile homes built before this date)

- Is permanently placed on a plot

- Will be permanently placed on a plot

- Is classified as “real estate” by the state you live in

What makes a mobile home real estate in the eyes of the government varies by state. But generally speaking, it needs to meet these requirements:

- The home must have a permanent foundation on a land parcel.

- The wheels and chassis must be removed from the home.

- The home must connect to electric and other utilities.

Borrower Requirements (COE)

To qualify for a VA loan for a mobile home, you first need to get a Certificate of Eligibility (COE).

Getting a COE is the first step in getting a VA loan for a mobile home because it tells lenders that you meet the VA’s qualification criteria.

COE criteria include:

- Not have been dishonorably discharged

- Meet the minimum service requirements

The minimum service requirements vary depending on when you served and what component you served in.

Take a look at the table below for the minimum service requirements that apply to you:

| Qualifying Wartime & Peacetime Periods | Qualifying Active Duty Dates | Minimum Active Duty Service Requirements | |

| Veterans | WWII | 9/16/1940 – 7/25/1947 | 90 total days, or Less than 90 days if you were discharged for a service-connected disability |

| Post-WWII | 7/26/1947 – 6/26/1950 | 181 continuous days, or less than 181 days if you were discharged for a service-connected disability | |

| Korean War | 6/27/1950 – 1/31/1955 | 90 total days, or less than 90 days if you were discharged for a service-connected disability | |

| Post-Korean War | 2/1/1955 – 8/4/1964 | 181 continuous days, or less than 181 days if you were discharged for a service-connected disability. | |

| Vietnam War | 8/5/1964 – 5/7/1975 *For Veterans who served in the Republic of Vietnam, the beginning date is 2/28/1961 | 90 total days, or less than 90 days if you were discharged for a service-connected disability. | |

| Post-Vietnam War | 5/8/1975 – 8/1/1990 | 181 continuous days, or Less than 181 days if you were discharged for a service-connected disability | |

| 24-month rule | 9/8/1980 – 8/1/1990 * The beginning date for officers is 10/17/1981 | » 24 continuous months, OR » The full period (at least 181 days) for which you were called or ordered to active duty | |

| Gulf War | 8/2/1990 – Present | » 24 continuous months, OR » The full period (at least 90 days) for which you were called or ordered to active duty | |

| Active Duty Servicemembers | NA | 90 continuous days | |

| National Guard & Reserve Members | Gulf War | 8/2/1990 – Present | 90 days of active service |

| OR, six years of service in the Selected Reserve or National Guard, AND Were discharged honorably, OR Were placed on the retired list, OR Were transferred to the Standby Reserve or an element of the Ready Reserve other than the Selected Reserve after service characterized as honorable, OR Continue to serve in the Selected Reserve | |||

Even if you don’t meet these minimum service requirements, you could still get a COE if you were discharged due to:

- Hardship

- The convenience of the government (you must have served at least 20 months of a 2-year enlistment) or

- Early out (you must have served 21 months of a 2-year enlistment)

- Reduction-in-force

- Certain medical conditions

- Service-connected disability

Keep in mind: Even with a COE in hand, you’ll still need to meet lender-specific requirements. These vary depending on the loan company, but they typically include things like minimum credit scores and minimum income requirements.

How to Request a Certificate of Eligibility (COE)

There are three ways to request a COE from the VA

- Online at VA.gov

- Through your lender. You can ask your lender if they’re able to request a COE on your behalf using the Web LGY system.

- By mailing a completed VA Form 26-1880 to your regional VA loan center

Before requesting your COE, gather the documents that prove you’re eligible for a VA loan for a mobile home.

Which documents you’ll submit with your COE request depends on your service:

Veteran

- You’ll need a copy of your discharge or separation papers (DD214)

Active Duty Service member

- You’ll need a statement of service that is signed by your commander, adjutant, or personnel officer. This letter should include:

- Your full name

- Your Social Security number

- Your date of birth

- The date you entered duty

- The duration of any lost time

- The name of the command providing the information

Current or former activated National Guard Member

- If you’re a current or former activated National Guard member, you’ll need a copy of your DD214 or other discharge documents.

- If you’re a current or former activated National Guard member with at least 90 days of active-duty service, including at least 30 consecutive days, you’ll need a copy of 1 of these documents that shows your activation date:

- Your DD214 that shows 32 USC sections 316, 502, 503, 504, or 505 activation or

- An annual point statement, or

- Your DD220 with accompanying orders

Current or former activated Reserve member

- You’ll need a copy of your DD214 or other discharge documents.

Current member of the National Guard or Reserve who has never been activated

- You’ll need a statement of service signed by your commander, adjutant, or personnel officer that shows this information:

- Your full name

- Your Social Security number

- Your date of birth

- The date you entered duty

- Your total number of creditable years of service

- The duration of any lost time

- The name of the command providing the information

Discharged member of the Reserve who was never activated

- You’ll need a copy of your latest annual retirement points and proof of your honorable service.

Surviving spouse of a veteran who died on active duty or who had a service-connected disability

- You’ll need your spouse’s discharge documents (DD214) if available, AND

- If you’re receiving Dependency & Indemnity Compensation (DIC), you’ll need to complete and submit VA Form 26-1817

- If you don’t get DIC benefits, you’ll need to submit all of these:

- A completed VA Form 21P-534EZ, AND

- A copy of your marriage license, AND

- Your spouse’s death certificate

You can learn more about requesting a COE as a surviving spouse on the VA’s website.

How to Buy a Mobile Home with a VA Loan

- After you secure your COE from the VA, the next step in your mobile home buying process is to budget for a mobile home you can afford. The VA recommends taking a hard look at your finances and deciding how high of a monthly payment you can afford. This payment is determined by the total amount of the loan, the loan term (how many monthly payments you’ll have), and your interest rate.

- If you decide that you can afford to buy a mobile home, it’s time to shop for lenders. You should talk with several private lenders and find one that offers loan terms that work within your budget and homebuying timeline.

- Once you find a lender, it’s time to find your home! Unless you already have a mobile home picked out, it’s a good idea to hire a real estate agent. They can help you find the perfect mobile home that meets all of your needs.

- When you find your perfect home, work with your agent to create a purchase agreement. The VA recommends including a VA escape clause in this agreement. This way, if the mobile home doesn’t appraise for the amount of the loan, you can void it. Without a VA escape clause, you could end up stuck with a loan for more than you need.

- Next, have the mobile home appraised and inspected for defects and minimum property requirements.

- If the home passes inspection, you’re ready to review your closing documentation. During closing, you’ll be presented with a lot of paperwork. Be sure to read through it carefully, regardless of how tedious it feels.

- Finally, you’re ready to move into your new home!

Benefits of a VA Loan for a Mobile Home

- No downpayment (In most cases. According to the VA, about 90% of VA-backed loans are made without a down-payment)

- Competitive interest rates

- Lower closing costs

- No need for Private Mortgage Insurance (PMI)

- The VA home loan guarantee is a lifetime benefit. You can use it multiple times.

What Types of VA Loans Can I Get for a Mobile Home?

There are two VA loan programs. You can use either to buy a mobile home:

- VA-direct loan. With this type of loan, the VA is your lender. You’ll work directly with them during the application process.

- VA-backed loan. This is when the VA guarantees a portion of a loan made by a private lender. There are two types of VA-backed loans you can use to buy a mobile home:

- Purchase Loan. This type of VA-backed loan can be used to buy, build, or improve a mobile home.

- Interest Rate Reduction Refinance Loan (IRRRL). If you already have a VA-backed loan for a mobile home, you can use an IRRRL to lower your monthly mortgage payment. This is also called a VA streamline refinance.

Deserve a Higher VA Rating?

Book a no-obligation VA Claim Discovery Call with an experienced team member. We’ll review your situation, spot what the VA may have missed, and help you map out a strategy to unlock the VA disability rating and tax-free compensation you’ve earned for your service. Click the red button below to book your call.

How Much Can I Get for a VA Loan for a Mobile Home?

The amount you can get for a VA loan for a mobile home depends on factors such as:

- The value of the plot it sits on

- The value of the mobile home

- Closing costs

- The VA funding fee

Look over the table below for more detailed criteria for your maximum loan amount:

| Allowable Loan Purpose | Maximum Loan Amount |

| To purchase a manufactured home to be affixed to a lot already owned by the veteran. | (The lesser of) The total purchase price of the manufactured home unit and the lot plus the cost of all other real property improvements, OR The purchase price of the manufactured home unit plus the cost of all other real property improvements plus the balance owed by the veteran on a deferred purchase money mortgage or contract given for the purchase of the lot, OR The total reasonable value of the unit, lot, and property improvements PLUS The VA funding fee. |

| To purchase a manufactured home and a lot to which it will be affixed. | (The lesser of) The sum of the balance of the loan being refinanced plus the purchase price of the lot, not to exceed its reasonable value plus the costs of the necessary site preparation as determined by VA plus a reasonable discount on that portion of the loan used to refinance the existing loan on the manufactured home plus authorized closing costs, OR The total reasonable value of the unit, lot, and real property improvements PLUS The VA funding fee. |

| To refinance an existing loan on a manufactured home and purchase the lot to which the home will be affixed. | The sum of The balance of the VA loan being refinanced, plus Allowable closing costs, Up to two discount points, plus The VA funding fee. Note: This is the only type of permanently affixed manufactured home loan that does not require full underwriting and an appraisal. The provisions applicable to IRRRLs apply except the term of the loan may be as long as 30 years and 32 days. |

| An IRRRL to refinance an existing VA loan on a permanently affixed manufactured home and lot. | (The sum of) The balance of the VA loan being refinanced, plus Allowable closing costs, Up to two discount points, plus The VA funding fee. Note: This is the only type of permanently affixed manufactured home loan that does not require full underwriting and an appraisal. The provisions applicable to IRRRLs apply except the term of the loan may be as long as 30 years and 32 days. |

Can I Get a VA Loan for Land and a Mobile Home?

Yes, you can get a VA loan for the plot where your mobile home is or will be permanently placed. You don’t need to already own the plot of land.

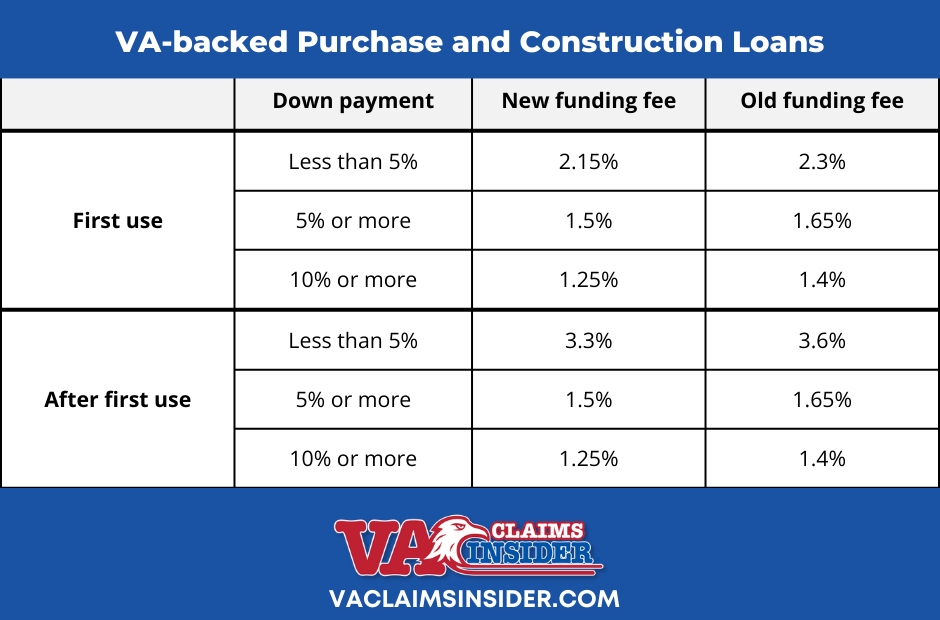

VA Funding Fees

Included in the closing costs of your VA loan for a mobile home will be what’s called the VA funding fee. This is a one-time fee that you pay to the VA at closing, and it can be as high as 25% of the loan.

The purpose of the VA funding fee is to reduce the burden VA loans have on US taxpayers. Because VA-backed loans are secured with federal dollars, whenever a VA loan is defaulted on, it’s ultimately the taxpayer who foots the bill. The VA funding fee helps the VA cover its losses in the event you default on your loan.

Several VA funding fees were reduced in 2023. The charts below show the old and new VA funding fees, so you can see how much this reduction saves you!

VA Funding Fee Exemptions

If any of these describe you, you could be eligible for a VA loan funding fee exemption:

- You have a VA rating and receive VA disability compensation. Or you’re eligible for VA disability compensation but are receiving military retirement pay or active duty pay instead.

- You receive Dependency and Indemnity Compensation (DIC) as the surviving spouse of a veteran.

- You’ve received a proposed or memorandum rating before the loan closing date that says you’re eligible to get compensation because of a pre-discharge claim.

- You’ve received a Purple Heart and have provided evidence of it before the closing date of your loan.

VA Funding Fee Waived

If you’re in the market for a VA home loan and want to avoid the pricey VA funding fee, then you should consider pursuing your VA disability.

A rating as low as 10% could make it so you don’t have to pay the VA funding fee.

If you think you’re eligible for a VA rating but don’t know where to start, then you’re in the right place. VA Claims Insider is the #1 most-trusted name in VA disability claims.

All you need to do is reach out and schedule your VA Claims Insider Discovery Call.

This is a short but powerful call that can get you connected with a coach who can support and educate you through the VA claims process.

List of VA-Approved Lenders

These are just a few of the lenders who may be able to offer you a VA loan on manufactured homes:

About VA Claims Insider

- VA Claims Insider is a highly rated, veteran-owned and operated business.

- 25,000+ disabled veterans served in our membership programs since 2016.

- Employs 200+ teammates; comprised of 44 veterans as well as military spouses.

- 4.7/5.0 average rating out of 5,000+ total reviews; over 4,000 5-star reviews.

Clay Huston

Clay Huston is a former U.S. Army Reserves Blackhawk Pilot and officer. Clay enlisted in the Army in 2013 and was commissioned as a 2LT in 2017 after earning a business degree from the University of Illinois Champaign-Urbana.

Since separating from the military, Clay has pursued a career as a writer. He also runs the nonprofit notfatherless.org, which fundraises for Children’s Homes in Mexico.