Looking for Expert-Level VA Claim Answers?📱Call Us Now! 737-295-2226

In addition to federal benefits that are available to all eligible U.S. military veterans no matter where they live, each state offers additional benefits for veterans that are unique to that state.

A wide variety of Alabama veterans benefits for you and your family are available to support you and honor your service!

Table of Contents

Top Alabama Veterans Benefits

Alabama veterans benefits include:

- Tax breaks

- Property tax exemptions

- Education and tuition assistance

- Vehicle licensing

- Preferred hiring status for employment

- Hunting and fishing license privileges

- Access to state parks

Many of these Alabama veterans benefits are administered by the Alabama Department of Veterans Affairs.

Additionally, other Alabama veterans organizations, such as Alabama Veteran, provide overviews of Alabama veterans organizations at the state, county, and city level.

Eligibility for some veteran benefits may depend on residency, military component, and veteran disability status.

Alabama Veterans Benefits for Taxes

There are multiple financial benefits available to you. Alabama veteran benefits include several tax breaks.

Homestead Tax Exemption for Alabama Veterans

Veterans who are Alabama residents are exempt from all state, county, and city property taxes if they are over 65—or if, regardless of age, are either blind or retired due to permanent and total disability.

The veteran must have a net annual income of $12,000 or less.

Permanently and Totally Disabled veterans in Alabama are exempt from all ad valorem taxes and there is no income limitation.

Alabama Homestead Exemption Chart

Other Property Tax Exemptions for Alabama Veterans

Homes acquired under the VA’s specially adapted housing grant are exempt from property taxation. The house must be owned and occupied by the veteran or surviving spouse.

Alabama Retirement Pay is Tax-Exempt

Veterans receiving retirement pay as a pension, annuity, or similar allowance, are exempt from Alabama state tax.

Tax-exempt Disability Payments

These payments are considered disability benefits and are not taxed in Alabama:

- Disability compensation and pension payments to disabled veterans or their families

- Grants for homes designed for wheelchair living

- Grants for motor vehicles for veterans who lost their sight or the use of limbs, or

- Benefits under a dependent-care assistance program.

Alabama Veterans Benefits for Education

Alabama offers several education benefits to veterans and their families, including financial assistance, scholarships, tuition waivers, high school diplomas, and extra help for children of military families.

Alabama National Guard Education Assistance Program (ANGEAP)

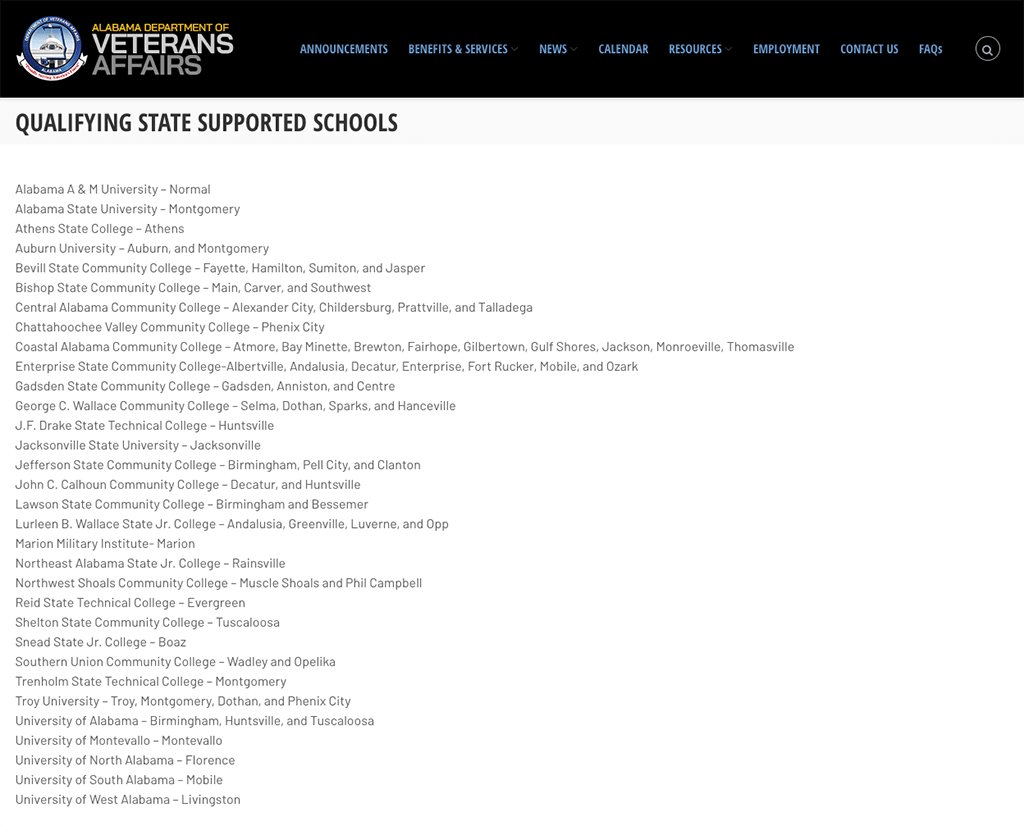

ANGEAP provides financial educational assistance to Alabama National Guard members attending college at an Alabama State-Supported School.

The current award amount per semester is $5,464 or $4,098 per quarter. ANGEAP will cover tuition and fees that are not covered by any VA education benefits.

An eligible student must:

- Be 17 years of age or older

- Be an active member in good standing with the Alabama National Guard

- Have completed basic training

- Be pursuing the first undergraduate program

- Be enrolled in a certificate or degree program at an accredited community college or technical college within the State of Alabama

- Be eEnrolled in a degree program at an accredited college or university within the State of Alabama

- Earn a cumulative 2.00 GPA for undergraduate degrees

- Earn a cumulative 3.00 GPA at the end of each semester for graduate degrees

- Keep the Free Application for Federal Student Aid (FAFSA) on file

- Be able to demonstrate a financial need of at least $100.00.

Alabama National Guard Educational Assistance Program Application

The Alabama G.I. Dependents Scholarship Program

Alabama offers varying-duration scholarships for eligible dependents of resident disabled veterans.

These scholarships are available at any Alabama State-Supported School for undergraduate courses at the in-state tuition rate.

Children and stepchildren of qualified veterans receive five standard academic years (10 semesters). The spouse or unremarried surviving spouse of a veteran who is 100% permanently and totally disabled is eligible for five standard academic years (10 semesters). The spouse or unremarried surviving spouse of a veteran rated 40%-90% disabled is eligible for three standard academic years (six semesters).

The scholarship will pay $250 per semester hour and up to $1,000 for textbooks and applicable fees for each semester. Schools may waive any overages of these charges at their discretion.

All scholarships and grants must be applied to education expenses first. The Alabama G.I. Dependents Scholarship Program will be applied for any remaining charges.

Veterans and their dependents must meet the following qualifications:

- A dependent is defined as a child, stepchild, spouse or unremarried surviving spouse of the veteran.

- The veteran must have been honorably discharged after at least 90 days of continuous active federal military service, or been honorably discharged because of a service-connected disability after serving fewer than 90 days.

- The veteran must be rated 40% or more due to service-connected disabilities, OR must be

- A former prisoner of war

- Declared missing in action

- Deceased as the result of a service-connected disability, or

- Deceased in the line of duty while in active military service

Veterans with a disability rating of 20% to 30% may qualify if the effective date of their disability rating is on or before July 31, 2017.

Eligible veterans can meet the requirements through one of the following two paths:

- A 100% permanent and total (P&T) disabled veteran needs only to have been a resident for at least five years immediately prior to the date of application (or prior to the date of the veteran’s death).

- Otherwise, a veteran must have been a permanent civilian resident for at least one year immediately prior to initial entry into active military service (or one year prior to a later entry into active military service after a 12-month break in service), AND meet one of the following residency requirements:

- Resident for at least two years immediately prior to the date of application (or prior to date of veteran’s death), OR

- Discharged within the last 12 months, OR

- Filed a resident Alabama income tax return for the past 10 consecutive years.

Students applying for benefits for the first time must meet all the following requirements:

- Must be a current resident at the time of application.

- Must complete a Free Application for Federal Student Aid (FAFSA) for each year that they are covered under the Alabama G.I. Dependent Scholarship Program.

- Show satisfactory academic progress as defined by their education institution.

- Complete a Family Educational Rights and Privacy Act release form for the school they are attending.

- Start school before their 26th birthday (in certain situations, a child or stepchild may be eligible for the program up to age 30). If the applicant is a stepchild, the veteran and stepchild’s parent must be legally married before the child’s 19th birthday.

The Alabama Department of Veterans Affairs (ADVA) can assist with the application process. To find your nearest Veterans Service Office, visit the Veterans Service Office Locator Page. You can download a PDF for a summary of the Alabama G.I. Dependents Scholarship Program.

Learn more about the Alabama G.I. Dependent Scholarship Program

Tuition Waiver for Purple Heart Medal Recipients

Alabama state-supported schools may waive tuition and fees for recipients of the Purple Heart Medal for undergraduate degrees up to 125% of the required credit hours for the degree or certificate program the veteran is enrolled in.

Eligible veterans must be enrolled as a full-time, part-time, or summer school student in an undergraduate program that results in a degree or certificate. The veteran must have been an Alabama resident at the time they were awarded the Purple Heart.

This waiver is only available after all other educational benefits are used, except for benefits that are partially funded by the veteran, such as the Montgomery G.I. Bill or Post 9-11 G.I. Bill.

Veterans should contact the public institution they plan to attend for more information.

Learn more about Alabama Tuition Waiver for Purple Heart Medal Recipients

“Operation Recognition”: High School Diplomas for Alabama Wartime Veterans

Veterans who left school before graduating to serve in the U.S. Armed Forces can receive high school diplomas if they served at any time between the following dates:

- December 7, 1941 through January 1, 1946

- June 27, 1950 through January 31, 1955

- November 15, 1961 through March 28, 1973

Veterans must have been a resident of Alabama before entry into the U.S. Armed Forces and have received an honorable discharge.

To apply for the diploma, veterans or family members should contact the high school principal’s office at the veteran’s former high school, or that county’s superintendent of education.

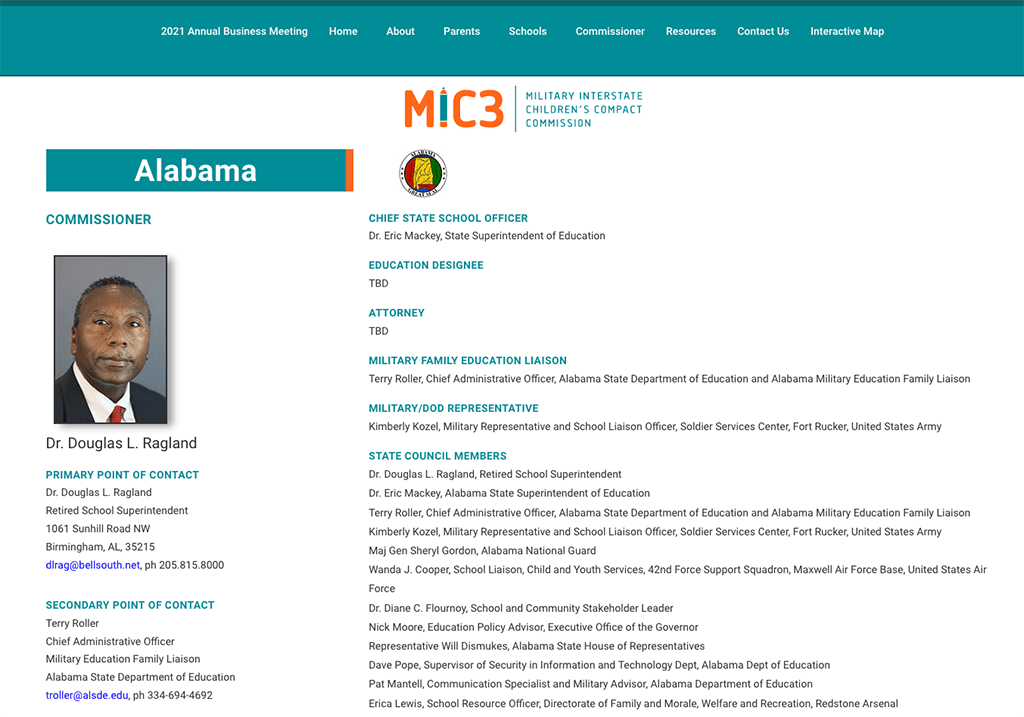

Benefits for Alabama Veterans’ Children: The Interstate Compact on Educational Opportunity for Military Children (MIC3)

This compact was designed to remove barriers to educational success faced by children of military families because of frequent moves and deployment of their parents. This program:

- Facilitates the timely enrollment of children of military families and ensures that they are not placed at a disadvantage due to difficulty in the transfer of educational records from the previous school district or variations in entrance or age requirements.

- Facilitates the student placement process through which children of military families are not disadvantaged by variations in attendance requirements, scheduling, sequencing, grading, course content or assessment

- Facilitates the qualification and eligibility for enrollment, educational programs, and participation in extracurricular academic, athletic and social activities

- Facilitates the on-time graduation of children of military families

- Provides for the uniform collection and sharing of information between and among member states, schools and military families

- Promotes coordination between this compact and other compacts affecting military children

- Promotes flexibility and cooperation between the educational system, parents and the student in order to achieve educational success for the student

Request MIC3 assistance online or call 205-815-8000.

Learn more about the Alabama Interstate Compact on Educational Opportunity for Military Children

Alabama Veterans Benefits for Employment

Hiring Preferences for Alabama Veterans

In addition to well-known federal guidelines regarding hiring and rehiring, Alabama offers several of its own employment benefits to resident veterans.

Alabama State Employee Job Status and Reemployment Rights

When called into or entering military service, state employees in the unclassified service have the same rights and privileges to re-employment as employees in the classified service.

State employees who are called to active service during a national emergency have protection of job status and reemployment rights.

Alabama Veterans State Employee Hiring Preference

Alabama offers state employment hiring preference to eligible Alabama veterans, Alabama disabled veterans, spouses, and surviving spouses.

Preference is given as points added to examination scores when applying for state employment:

- Honorably discharged veterans receive 5 points

- Veterans receiving disability compensation from the VA receive 10 points

- Spouses of disabled veterans who are unable to work due to their disability receive 10 points

- Surviving spouses of service members killed in the line of duty receive 10 points

When reductions in force are being made, employees eligible for military preference must be the last to be discharged, dropped, or reduced in rank or salary. The employee must have a good record with an efficiency rating equal to or greater than competing employees.

Membership in Employees’/Teachers’ Retirement System of Alabama (RSA) Benefits for Alabama Veterans

State employees and teachers who enter the U.S. Armed Forces and return to state employment can keep their RSA benefits and may receive credit for up to 4 years of military service.

A member of the RSA who enters the U.S. Armed Forces and continues to make contributions, and then returns to state employment within one year after being honorably discharged, is eligible to keep RSA benefits.

Additionally, Alabama veterans can purchase service credit for each full year of military service. Service credit may increase state retired pay or allow RSA members to receive retired pay sooner. The cost to purchase military service credit is 4% of the average salary paid to a state employee during each claimed year, plus 8% interest, compounded from the last date of service to the date of payment.

Alabama Peace Officers Credit for Military Service

Any peace officer who is a member of the Alabama Peace Officers Annuity and Benefit Fund, enters into the U.S. Armed Forces, and returns to work as a peace officer within six months after discharge can receive credit for service in the military (not to exceed five years). Service credit may increase retired pay or allow Peace Officers Annuity and Benefit Fund members to receive retired pay sooner.

Reduced-Cost Business and Occupational Licenses for Alabama Disabled Veterans

Eligible disabled veterans are charged a reduced fee of $25 for state/county/municipal business or occupational license taxes.

To be eligible, veterans must:

- Be an Alabama resident who served during wartime

- Be rated 25% or more disabled by the VA (the disability need not be service-connected)

- Be self-employed and have no more than one employee

Veterans whose property (both real estate and personal property) is valued at $5,000 or more, or whose net annual income is $2,500 or more, are not eligible.

Are you STUCK, FRUSTRATED and UNDERRATED?

You are not alone! We are Veterans helping Veterans!

Become an Elite Member and work with our Veteran Coaches to get the rating you deserve!

Alabama Veterans Benefits for Vehicle and Driver’s License

The Alabama Department of Transportation offers several helpful exemptions, licensing services, and special plates to Alabama veterans.

Exemption for Vehicles Paid For by a VA Grant

Vehicles owned by a disabled veteran that are all or partly paid for by the VA are exempt from all license fees and property taxes.

The vehicle must only be for the private use of the veteran.

Veteran Designation on Alabama Driver License

Alabama veterans have the option of displaying proof of military service on their driver license. There is no charge for the veteran designation for a first-time driver license applicant or for an individual renewing their license.

If you choose to add the designation before the renewal date, you must pay the standard fee for a duplicate license.

To be eligible, you must visit one of the Alabama Law Enforcement’s driver license offices and present your DD214 showing an “honorable” or “general under honorable conditions” discharge.

Fees Waived for Vehicle Privilege or License, Tax, and Registration for Reserve Component Service Members, Retirees and Gold Star Families

Alabama offers a vehicle privilege or license/tax/registration fee exemption for eligible reserve component service members, disabled veterans, retirees, and Gold Star Families.

The following Alabama residents are eligible:

- Active and retired Alabama National Guard members

- Active members of the U.S. Armed Forces Reserve

- Gold Star Families

- Disabled veterans

Alabama Veteran and Military License Plates

Alabama offers 35 specialized vehicle license plates to honor the service and sacrifice of service members, veterans, retirees, and eligible family members. Visit the Alabama VA online for details on these distinctive plates.

Alabama Medal of Honor License Plate

Medal of Honor plates for passenger cars, trucks, motorcycles, and pleasure motor vehicles are exempt from registration fees and taxes for the first plate. Fees and taxes must be paid for any additional plates.

A resident of Alabama who has received the Medal of Honor, or the surviving spouse of the recipient, is eligible. Applicants must provide one of the following:

- DD214

- Certification from the Alabama VA

- An affidavit from Veterans Affairs

Alabama Purple Heart License Plate

Purple Heart plates for passenger cars, trucks, motorcycles, and pleasure motor vehicles are exempt from registration fees and taxes for the first plate. Fees and taxes must be paid for any additional plates.

Alabama veterans who have received the Purple Heart are eligible. Surviving spouses of recipients may keep this license plate, but they may not order one.

Applicants must provide one of the following:

- DD214

- Certification from the Alabama VA

- An affidavit from Veterans Affairs

Alabama Disabled Veteran License Plate

Any veteran who is an Alabama resident and has service-connected disabilities is eligible for the Alabama Disabled Veteran license plate. Surviving spouses of a veteran may not order or retain this license plate.

Fees are as follows:

- Veterans with a 10% or higher disability rating: first license plate is exempt from registration fees; plate may be displayed on private passenger automobiles, pickup trucks, motorcycles, and pleasure motor vehicles.

- Veterans with over 50% disability rating, or whose vehicle has special mechanical control devices: annual fee of $5.00; plate may be displayed on private passenger automobiles, pickup trucks, motorcycles and pleasure motor vehicles.

If the vehicle is all or partly paid for by the VA, the first license plate is exempt from registration fees and taxes.

Alabama disabled veterans are not required to have the Disabled Veteran license plate to claim the registration fee exemption/reduction.

The Alabama Disabled Veteran license plate cannot be personalized.

Applicants must provide a VA Disability Rating Certification and one of the following:

- Identification card

- DD214

- Affidavit from Veterans Affairs

Applicants who wish to have disability parking access displayed on this license plate must also submit a completed Application for Disability Access Parking Privileges.

Alabama Gold Star Family License Plate

The immediate family of a person who died while on active duty in any branch of the U.S. Armed Forces may receive the Gold Star Family license plate for passenger cars, trucks, motorcycles and pleasure motor vehicles.

The first plate is exempt from registration fees, taxes, and any fees; all fees and taxes must be paid for any additional plates. This plate may be personalized and is transferable to a spouse or child after paying transfer fees.

Applicants must provide one of the following:

- DD2064 – Overseas Death Certificate or prior era Department of Defense Death Certificate

- DD1300 – Report of Casualty

If the applicant is not identified as the next of kin on one of the documents listed above, the applicant must submit a notarized affidavit obtained from the Alabama VA certifying the applicant’s relationship to the deceased service member.

Alabama Commercial Driver License (CDL) Military Skills Test Waiver

Military service members who are currently licensed and were employed within the past year in a military transportation unit requiring the operation of a military motor vehicle equivalent to a commercial motor vehicle are eligible for a military skills waiver for a CDL.

Service members will still have to take the knowledge portion(s) of the CDL test, but the skills test will be waived. The form to have the skills portion waived is available at any CDL testing office and should be requested at the time the knowledge test(s) are being taken.

Alabama Veteran Benefits for Parks and Recreation

Alabama veterans benefits for recreation include reduced rates on hunting and fishing licenses as well as free admission to all Alabama state parks.

Alabama State Parks Admission Waiver for Veterans and Active-Duty Military

Alabama resident active-duty service members and honorably discharged veterans are granted free admission to state parks. Those wishing free admission must show their active or retired military ID card, an Alabama driver’s license with a veteran designation, or their DD214.

Active and retired military personnel who are not residents are authorized free admission only on state and federal holidays.

Nonresident Service Members Get Alabama Rates

Nonresident service members and their dependents can purchase hunting and fishing licenses for resident prices. Applicants must go to the local probate office or license commissioner and provide the following:

- Copy of orders assigning them to Alabama for 30 days or more

- A valid U.S. driver’s license

- A military ID

To be eligible, nonresident military personnel must meet the following requirements:

- Stationed in Alabama for 30 days or more

- Assigned to a state bordering Alabama and currently living in Alabama for at least 90 days

Military personnel assigned to Fort Benning who have a Fort Benning hunting or fishing license when hunting or fishing on base are not required to purchase an Alabama license.

Hunters are required to carry a harvest record and report any deer or turkey killed on base in Alabama to Game Check at the Alabama Department of Conservation and Natural Resources.

Get more information and order licenses online:

Alabama 50% and 100% Disabled Veteran Appreciation Hunting License

Alabama veterans who are certified by the VA to be 50% or more disabled can purchase a hunting license for $14.40. Alabama disabled veterans who are certified by VA to be 100% disabled may receive a hunting license for $3.15.

Apply at the local probate office or license commissioner, or in person at:

Alabama Department of Conservation and Natural Resources

64 N. Union St., Suite 567, Montgomery, AL 36104

or by mail:

Dept. of Conservation, Wildlife & Freshwater Fisheries

Attn: License Sales

P.O. Box 301456

Montgomery, AL 36130-1456

Applicants must provide a VA verification letter certifying their disability rating.

Alabama Disabled Military Veteran Appreciation 3-Day Event Hunting License

This Alabama veteran benefit allows for sponsored events hosting disabled veterans (residents and/or nonresidents) to hunt all game for three days in Alabama for $142.

Each license allows up to 10 disabled veterans on one license. The VA must certify all participating veterans to be 50% or more disabled. Forward completed applications to:

Dept. of Conservation, Wildlife & Freshwater Fisheries

Attn: License Sales

P.O. Box 301456

Montgomery, AL 36130-1456

Alabama 20% or More Disabled Military Veteran’s Appreciation Freshwater Fishing License

Veterans who are certified by VA to be 20% or more disabled may receive a freshwater license for $3.15. Applicants must provide a VA verification letter certifying their level of disability.

Alabama Veteran Benefits for Housing

Alabama has four veterans homes to care for Alabama resident veterans:

- Bill Nichols State Veterans Home in Alexander City

- Floyd E. “Tut” Fann State Veterans Home in Huntsville

- William F. Green State Veterans Home in Bay Minette

- Colonel Robert L. Howard State Veterans Home, in Pell City

Services provided include:

- 24-hour nursing coverage

- Physician on call 24 hours

- Physical therapy, occupational therapy, and speech therapy

- Pharmacy services

- Activities programs

- Dietary services

- Social services

To be eligible for care in any Alabama state veterans home, the individual:

- Must be honorably discharged after at least 90 days of active-duty service. Veterans who enlisted after September 7, 1980, and those commissioned after October 16,1981, must have served a minimum of 24 continuous months or the full period of their contract and be honorably discharged. A DD214 or equivalent must be included with the application package that documents full-time active service and discharge status.

- Must meet the qualifications of the VA for skilled nursing care or domiciliary/assisted living.

- Must have been a resident of Alabama during the past 12 months.

- Must have had a medical examination by a physician that shows the veteran does not have:

- Medical or nursing care needs that the home is not equipped or staffed to provide

- Behavioral traits that may prove to be dangerous to the well-being of the resident, other residents, staff, or visitors

- A diagnosis or confirmed history of mental illness or intellectual development disability that outweighs their medical condition.

- Must meet the requirements of Alabama’s immigration laws

Veterans who do not have wartime service may be admitted to the home on a space-available basis. These veterans will not be placed on a waiting list or placed before wartime veterans.

Alabama VA Medical Centers

- Birmingham: Birmingham VA Medical Center

- Montgomery: Central Alabama Veterans Health Care System West Campus

- Tuscaloosa: Tuscaloosa VA Medical Center

- Tuskegee: Central Alabama Veterans Health Care System East Campus

Useful Resources for Alabama Veterans

Alabama Department of Conservation and Natural Resources

U.S. Department of Veterans Affairs, Facility Directory, Alabama

FedsHireVets, Veterans’ Preference

National Guard Association of Alabama, Insurance

U.S. Department of Labor, Veterans’ Employment and Career Transition Advisor

Military Interstate Children’s Compact Commission, Alabama

Alabama Department of Veterans Affairs, Alabama Laws Affecting Veterans

Frequently Asked Questions (FAQ)

Are there tax exemptions available to veterans in Alabama?

Yes, Alabama veteran residents who are over 65—or blind or retired due to permanent and total disability, regardless of age—are exempt from all state, county, and city property taxes. The veteran must have a net annual income of $12,000 or less. Additionally, homes acquired under the VA’s specially adapted housing grant are exempt from property taxation. The house must be owned and occupied by the veteran or their surviving spouse. Veteran disability payments for personal injury or sickness resulting from active service, as well as retirement pay received as a pension, annuity, or similar allowance, are exempt from Alabama state tax.

Is there educational assistance available to disabled veterans’ and their families?

Alabama offers varying-duration scholarships for eligible dependents of resident disabled veterans. These scholarships are available at any Alabama State-Supported School for undergraduate courses at the in-state tuition rate. Also, Alabama state-supported schools may waive tuition and fees for recipients of the Purple Heart Medal for undergraduate degrees up to 125% of the required credit hours for the degree or certificate program the veteran is enrolled in.

Do Alabama veterans receive preferential treatment in hiring practices and employment?

Alabama offers state employment hiring preference to eligible Alabama veterans, Alabama disabled veterans, spouses, and surviving spouses. Also, when reductions in force are being made, employees eligible for military preference must be the last to be discharged, dropped, or reduced in rank or salary. The employee must have a good record with an efficiency rating equal to or greater than competing employees.

Are there special license plates available to Alabama veterans and their families?

Alabama offers 35 specialized vehicle license plates to honor the service and sacrifice of service members, veterans, retirees, and eligible family members. Visit the Alabama VA online for details on these distinctive plates.

Do veterans get special parks and recreation privileges in Alabama?

Yes, benefits include reduced rates on hunting and fishing licenses as well as free admission to all Alabama state parks, not just for Alabama veterans but for near-state and out-of-state veterans as well.

For answers to more questions, visit the Alabama Department of Veterans Affairs.

MAKE SURE YOU GET ALL THE BENEFITS YOU DESERVE

Regardless of what state you live in, it’s important that you pursue the monthly compensation payments due to you for disabilities connected to your military service.

Most veterans are underrated for their disabilities and therefore not getting the compensation they deserve.

At VA Claims Insider, we help veterans understand and take control of the claims process so they can get the rating and compensation they’re owed by law.

Our process takes the guesswork out of filing a VA disability claim and supports you every step of the way in building a fully-developed claim (FDC).

If you’ve filed your VA disability claim and have been denied or have received a low rating – or you’re not sure how to get started – reach out to us for a VA Claim Discovery Call, so you can FINALLY get the disability rating and compensation you deserve. We’ve supported more than 25,000 veterans to win their claims and increase their ratings. NOW IT’S YOUR TURN.

About the Author

About VA Claims Insider

VA Claims Insider is an education-based coaching/consulting company. We’re here for disabled veterans exploring eligibility for increased VA disability benefits and who wish to learn more about that process. We also connect veterans with independent medical professionals in our referral network for medical examinations, disability evaluations, and credible independent medical opinions and nexus statements (medical nexus letters) for a wide range of disability conditions.